An incident can occur that can result in a tragic loss where one needs financial help from someone. This loss can be of health, business, or any other personal life. A person can seek a loan from a debtor for any period of time. However, it is always a risky step to take.

Due to fluctuation in market value, the creditor might not be able to get its full amount, or the debtor might go bankrupt paying all that loan. To avoid this problem, debts are negotiated by both parties. That is where the agreement to pay debt comes in handy.

What is the Debt Settlement?

A debt settlement agreement is an arrangement between a creditor and a debtor to re-negotiate or bargain on a debt. The debt can be settled when a creditor agrees to forego a certain proportion of the remaining debt or lower the final sum for the actual amount owed.

Debt settlement can be sought when a borrower is facing degrading financial conditions, especially when installments along with interest are forcing the borrower into bankruptcy. The owner of the money can compromise on the debt by accepting a lesser amount than gambling on the future money. Debt settlement letter practices a method of settling debt by paying a lump sum money usually less than the owed amount to the lender.

Negotiations for debt settlement can be done by the borrower, or a third-party debt management firm can be hired to go through with the settlement. However, in a later case, negotiation can be subjected to legal fees.

Key Terms to Look For in a Debt Settlement Letter

Before jumping on offering a settlement and signing a debt settlement agreement, it is important to know its basic terminology. To avoid misunderstanding, confusion, or legal action, the borrower needs to understand the following key terms:

- Agreement/Settlement: It is an offered settlement by one party to another party. A settlement figure should always be less than the outstanding balance.

- Terms and Conditions: These are agreed-on terms about the amount collection, due date, settlement offer, and other specifics of a settlement contract.

- Structured Arrangements: A negotiated settlement is a series of payments made over a certain period of time, in simple words, also known as installments.

- Debt Original Creditor: The original creditors are basically a company that provides loans and credit to the borrower. An original creditor may either try to recover a due loan on account of its own or employ a debt collector.

- Debt Collection Agent: A debt collector is different from a lender. The collector agent is a legal entity that collects loans on behalf of the creditor.

- Collection Accounts: A Collection Account agency is a legal entity that collects on a past-due loan. Collection accounts are purchased, sold, or exchanged. Debt can be sold off by less than the current value, but the collection agency has the power to collect the debt by its full market value.

Merits and Demerits of a Debt Settlement Agreement

Although it could be enticing to use a debt settlement agreement to help pay down the debts. Bear in mind that it can also lead to even more debt. The following section will elaborate merits and demerits of the settlement.

Merits

- The debt settlement can help borrowers greatly by reducing the actual debt amount. The settlement payment can be of almost full debt amount if properly negotiated.

- The lowered borrowed amount can help to avoid bankruptcy and make remaining payment management easy.

- The continuous pressure by the creditors and collectors can be off.

Demerits

- Some creditors refuse to take the settlement offer. They would rather get paid monthly or face a loss than settling on a lesser amount.

- Even though the annual payments will be cut, there will always be a requirement to make a substantial lump amount payment to complete the settlement.

- After the settlement is completed, a lender may lock the credit account due to a bad track record of repaying debts.

- Any settlement with the creditors can be reported to the credit bureaus. This would have a significant negative effect on a good credit score.

- If debt settlement companies are hired, they may not charge for failed negotiations. However, on successful completion of the settlement, they may charge up to 50% of the total owed amount.

How to Create A Debt Settlement Agreement

A debt settlement agreement can be created on reaching an agreement with the creditor. There are numerous available templates on CocoDoc that specialize in meeting the contract demand. These templates can be modified as per the requirement of the settlement.

Following steps guides on selecting and creating a debt settlement agreement:

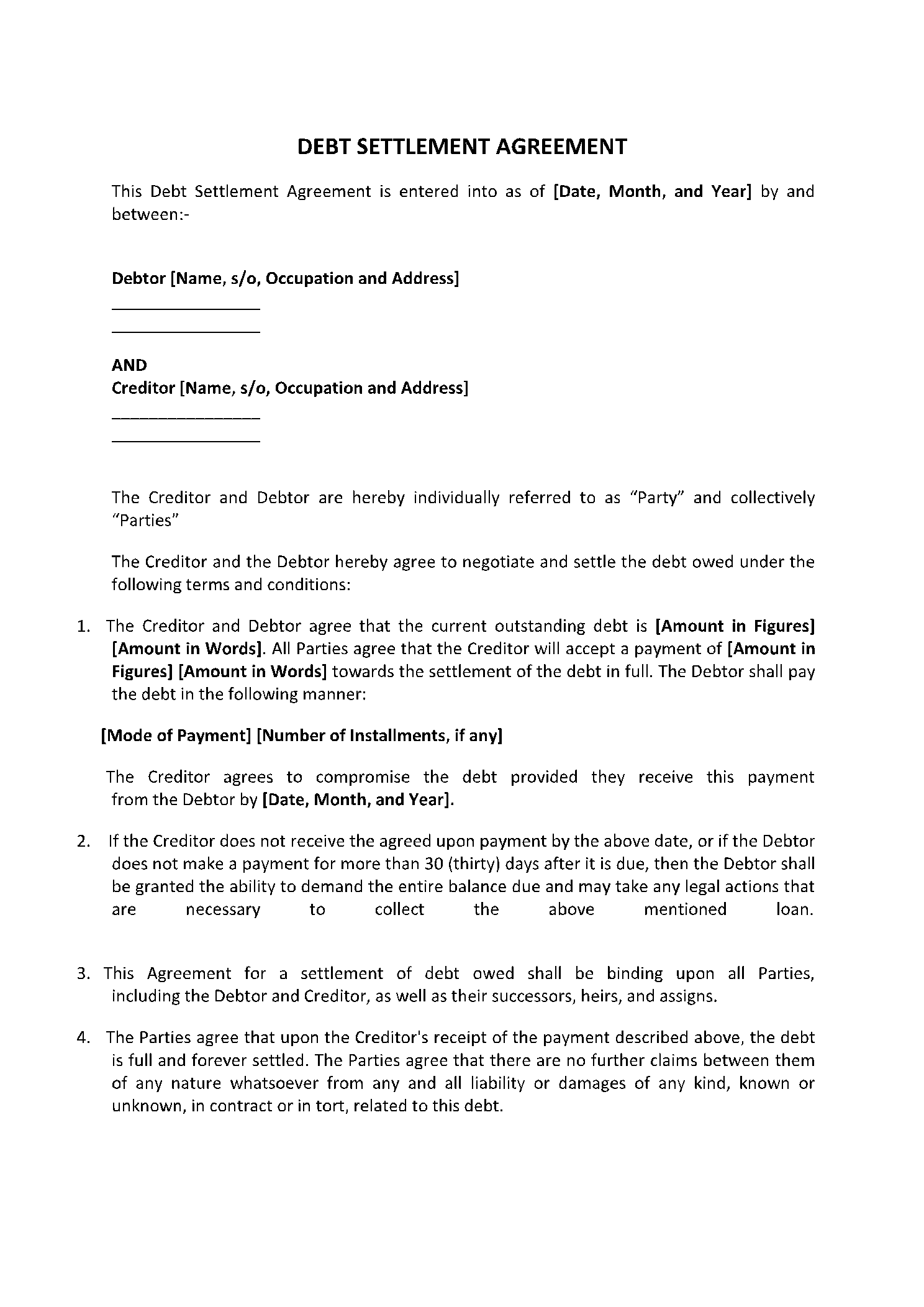

- Deciding an Agreement Format: The settlement agreement template on CocoDoc includes the necessary documentation to put a settlement agreement into effect. Download any format according to your need and requirement.

- Contact Details: Establish the parties, debtor, and creditor of the agreement. The legal name and contact information of both parties would be recorded in the respective section.

- Debt Details: Details about the debt taken and the actual owed amount at present by the borrower will be recorded.

- Settlement Offer: The clear amount of money the debtor has promised to pay in return for the creditor's reduction of the debt will be written down.

- Payment Method: This section identifies the method by which the settlement amount will be paid to the creditor. It can be through cash, cheque, bank wire, or any other payment method.

- Payment Date: Payments must be issued by a certain date to comply with the settlement arrangement.

- Terms and Conditions: If the creditor and borrower have agreed to specific contractual terms, mentioned those briefly in this section.

- Signature: The contract's final condition would be to commit all parties to its terms with their signatures.

Conclusion

Debts can be settled by the right negotiated, but it should be done by considering all the pros and cons of the settlement. This article delivered detailed information regarding the important key point along with designing details of the debt settlement agreement.