All limited liability companies (LLCs) should have an operating agreement that defines the company’s scope. An llc operating agreement may also be known as a ‘what if’ document since it’s a written guide that defines what should happen or follow if one situation or the other arises.

This article discusses in detail what an operating agreement llc is, how it works, key elements it must contain and what it is generally used for. As a plus, you can download an operating agreement template for free and for immediate use.

What Is an Operating Agreement & How It Works?

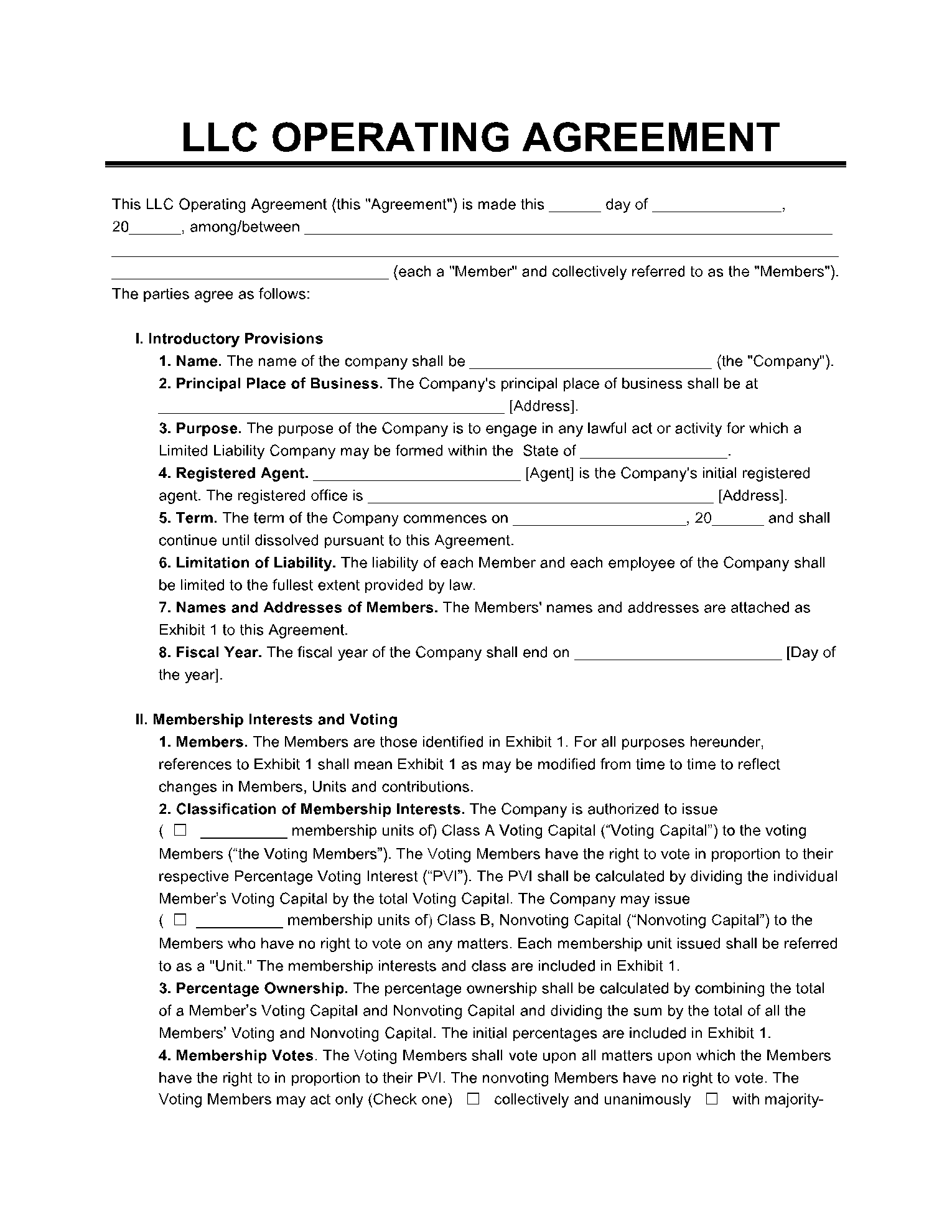

An operating agreement is a business operating agreement used by LLCs to outline their financial and functional rules, provisions and regulations. It also outlines the rights, duties and responsibilities of all relevant parties. It clarifies all rules of operations, names of members of the llc, highlights ownership and structure and dictates when the company should be dissolved..

Some of these rules of operation include when meetings should be held, how taxes should be distributed among members of the LLC and method of admission of new members.

The llc agreement is to be signed by all members of the llc. Once signed, the signatories become contractually bound to the dictates of the agreement’s content. Unlike articles of organization that are filed with the state, an operating agreement is an internal document. An operating agreement llc is not mandatory in all counties or states. However, drafting one is important and key to proper running of a llc. In the US, operating agreements are only mandatory in the states of Delaware, Missouri, New York, Maine and California.

Without an operating agreement, an llc falls under the default rules of the state. For instance, the state may require all partners irrespective of their initial contributions to share profits equally.

Key Elements of a LLC Operating Agreement

The following are key elements that must be found in every operating agreement for llc:

- LLC name: It is required by some state laws that the terms “Limited Liability Company” or LLC be written atop the llc operating agreement document.

- Duration of the LLC: It must be clearly what date beyond which the LLC ceases to exist. One way to write this is “until DD/MM/YY”.

- Address: This is the physical location of the headquarter office of the LLC.

- Name and address of the registered agent: It must contain the name and address of the individual who collects legal notices and correspondences on behalf of the LLC.

- Business purpose: Details about the business and what kind of services they are into

- Members, Contributions and Interest: This section highlights the contributions of each member of the LLC and how profits or losses are to be distributed amongst them. It also describes the process of admitting new members into the llc.

- Liability clause: This is just a clause that says that all members of the LLC have limited liability for their activities as part of the LLC.

Some llc operating agreements may contain a conflict of interest policy, non-disclosure agreement or non-compete agreement.

When Is an Operating Agreement for LLC Used?

An operating agreement for llc is important for limiting future disputes, protecting the limited liability status of the business, and protecting the business from the influence of the state’s default rules for an llc.

In general, an llc operating agreement should be used:

- If the business has a sole owner (Single member llc): An operating agreement may bring lots of credibility to a one-man business. It may also uphold the limited liability status of the business in the eye of the state.

- If the business has multiple partners (multi-member LLC): It goes a long way in fighting against disputes and misunderstandings between the members since it outlines in clear language and in black and white, the rights, roles and responsibilities of each party in the LLC.