Contracts that do not include specific details about responsibilities or terms and conditions eventually make a loss in business for both parties. The escrow agreement template consists of all factors of a valid contract. It includes the transactions, values of assets, responsibilities that need to be done for the fulfillment of the contract, and space for a third party.

The third party in the escrow agreement template is actually an escrow agent. The agent acts independently for fulfilling the contract needs. This third independent agent manages the regulation in funds payment and is responsible for all types of documentation work.

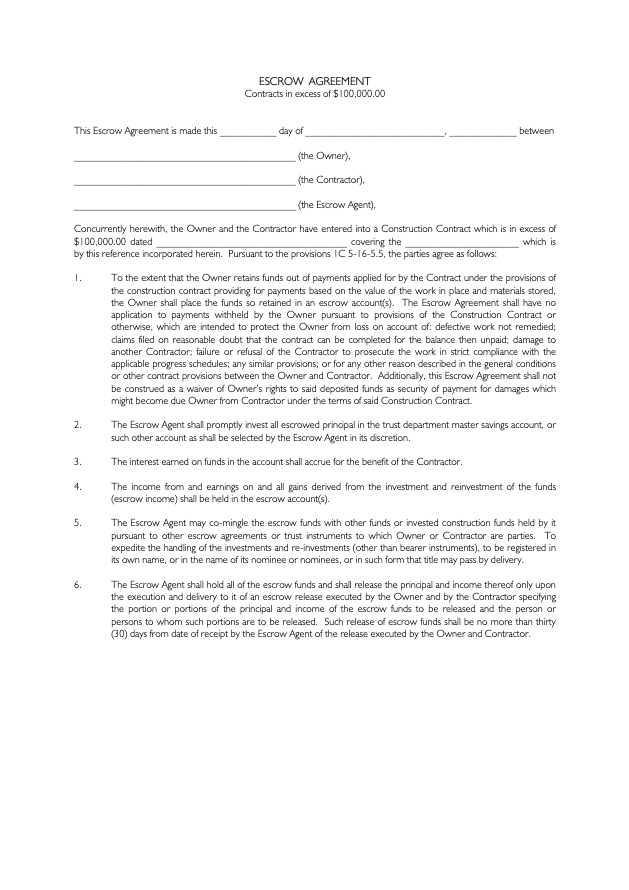

What Is an Escrow Agreement?

An escrow agreement is a legal contract agreement that focuses on the terms that need to complete according to the defined conditions. The detail of the duties and responsibilities of both parties is also included in the escrow agreement.

The escrow agreement sample contains the dealing details of the buyer and the seller. The escrow agent will make it possible for the deal to be done. In order to begin the deal, the buyer needs the seller to trust him. The buyer will give payment to the escrow agent to show that he actually wants to seal the deal with that seller.

An escrow agreement should specify the below statements in detail:

- What is Going to be Deposited in Escrow? The things which are going to deposit in the escrow account are the assets or funds of the parties and the detailed paperwork. The documents should be both in hard form and electronic form.

- When will Deposits be Delivering? The time of initial and subsequent deposits like documents and assets that are to be delivered in an escrow account.

- How will Parties Deliver the Deposits? Parties will deliver the deposits either in electronic form or in physical form as in a hard copy.

- Where will Deposits be Stored? The location of the escrow account where the escrow agent is going to keep the deposits safe.

What is Escrow Used For?

Escrow is an independent agent who behaves like a third party when it comes to accomplishing the needs of an escrow contract. Both parties use this third-party agent when they need to hand over something valuable like money or stocks. This has to be done to ensure a certain party that the other party is interested in investment or further collaborations.

This agent manages the documents, including the written form of the escrow agreement form. In the first delivery, both of the parties hand over the written agreement to the escrow. The agent will keep the written document until the contract terms are fulfilled.

The second delivery will happen when the terms are fulfilled by both parties. At this instant, the agent needs to give back the written agreement to the deserving party. This is how the third-party agent will be useful for the escrow agreement template in order to manage things smoothly.

Escrow is mainly used in situations when there are large amounts of funds involved in the contract. The basic example for escrow is the sale and purchase of a property in real estate. The other use of escrow is practiced in many corporate transactions.

Types of Escrow Agreements

There are two types of escrow agreement formats that are used according to the situation of the project.

- Three-Party Agreements: The three-party agreements are done between the Licensor, Escrow agent, and the Licensee. The escrow agreement will be negotiated between all three parties. There will be clear and customized terms and conditions of the contract. A signature of all three parties is required on the contract to begin the deal.

- Two-Party Agreements: A two-party agreement is made by two parties which are the Licensor and the Escrow agent. The licensor prepares all the terms and conditions of the agreement on his own. The Licensor and Escrow agent are advised to sign the agreement.

How Does Escrow Agreements Work?

The work structure of the escrow agreement initiates from the fact that the depositor side has to deposit some assets with the escrow. The escrow will keep that funds until the escrow contract is smoothly fulfilled. The agent will give those assets to the beneficiary party until the agreement conditions are met. The working of escrow agreements is explained in the next part through a basic example.

In real estate, the escrow company makes an account to keep the funds and the documents that are related to the transactions. They do not let the seller and buyer manage this directly and facilitate the transactions within the escrow account according to the contract conditions.

Conclusion

The preferable way of signing an agreement is to add an independent third party. This party will deal with the transactions and the responsibilities of both parties. This act makes the third party an escrow agent and the agreement, escrow agreement. The importance of working as an escrow agent in an agreement is very helpful, and all of its useful aspects are well explained in the above discussion.

This article shall explicitly guide the user to follow the defined guidelines and develop a perfect escrow contract that would protect the rights of both parties.