The important role of stock purchases in the economy is no longer hidden. The stock purchases enable companies to raise their funds so they can expand their businesses. It develops an interest in people to buy shares and gain a specific or variable amount of profit on it.

However, it is also important to have a written contract between seller and buyer, so both parties have legal proof related to the deal. Here, the article has discussed the types of stocks and the importance of signing a stock purchase agreement.

Types of Stock

A stock is a general term used to explain the ownership certificate of any company. It is a kind of agreement between a seller and purchaser which entitles the shareholder to a specific payment. There are two common types of stocks:

- Preferred Stock

- Common Stock

The article shall introduce and explain the difference between preferred and common stocks.

- Preferred Stock

- Common Stock

In preferred stock, the shareholders have no voting choice. When the company selects a board of directors, the shareholders of that company have no say in this matter. The investors are promised a fixed dividend permanently for the preferred stock bought by them.

When the dollar amount of dividend is divided by the price of the stock, the answer shows the dividend yield, which is paid to the stockholders. The par value is affected by the interest rate. When the interest rate rises, the value of preferred stocks will be declined and vice versa.

A stock sale agreement is a kind of stock that represents shares of ownership in a corporation. In common stock, most people are interested and usually invest in it. The common stockholders have a profit and have a voting right. Whenever an important decision regarding corporate policy and management issues is taken, the stockholders have their voting right in it.

Common stocks provide the biggest potential for long-term gains. If the company earns well, the stockholders are paid well.

What is a Stock Purchase Agreement?

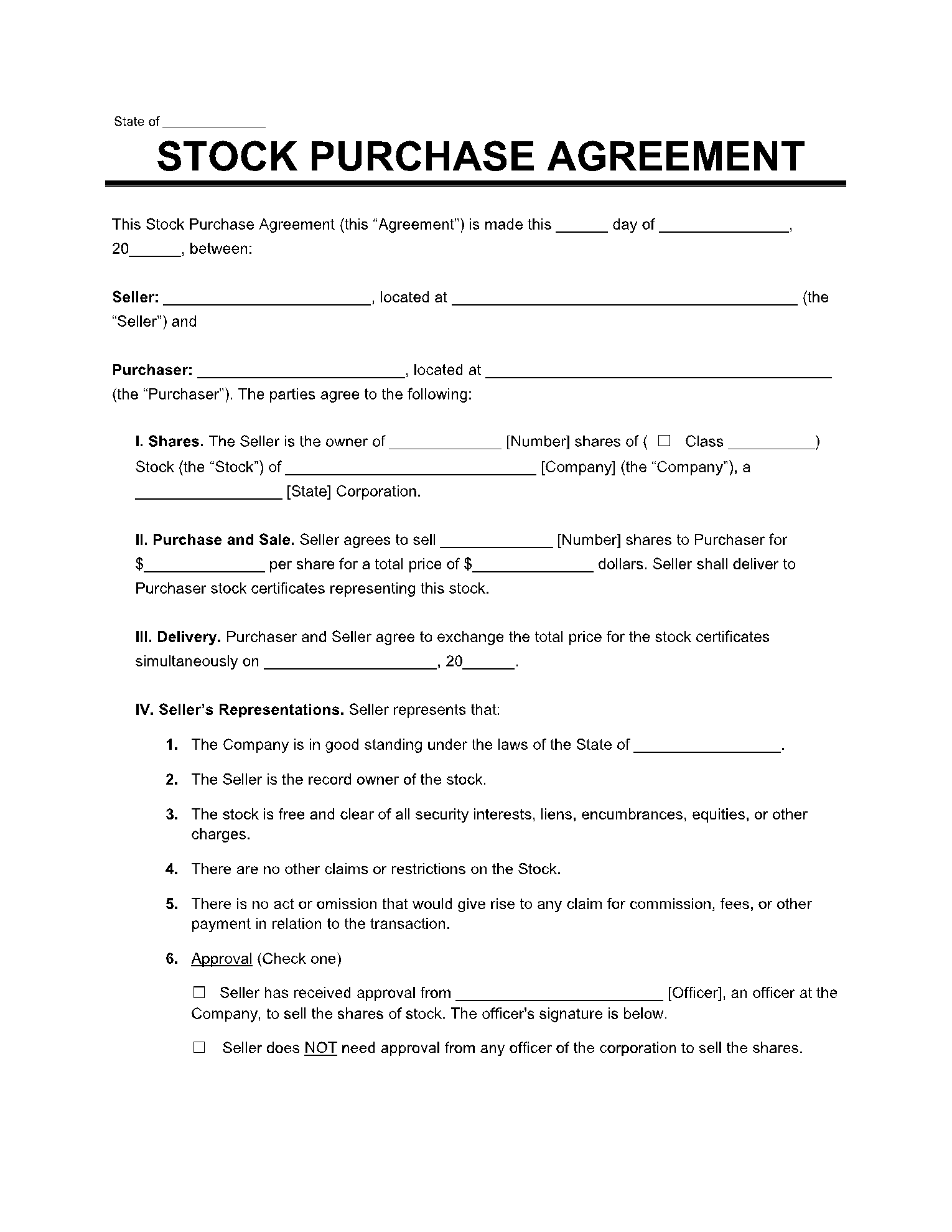

A share purchase agreement refers to the transfer of shares from the shareholder to the buyer. The agreement contains the transaction date, price per share, and name of the establishment that is selling its stocks in the transaction. Moreover, the agreement must contain the amount per share in it.

This stock purchase agreement template contains terms and conditions between the seller and purchaser who agrees to be bound by the agreement. The sample stock purchase agreement is used as a legal claim by both parties if something goes wrong. Therefore, promises and mutual agreements are written in the document.

At the ending of the contract, the seller transfers the shares and certificates of sold stocks to the purchaser. Purchaser pays the amount written in the agreement within the specified time. In a company, stocks are mostly sold for the sake of money or for some other compensation. It is usually common in small businesses and start-ups as an employee benefits from it.

The company that sells its stocks obtains funds and can expand the business when required. The contract arranges the provisions and warranties of the sale. It is a guarantee that stocks are being sold to the buyer, and he is the new owner of the shares. The number of shares is also displayed in the contract.

How to Write a Stock Purchase Agreement?

The stock sale agreement is highly monitored by the local and federal government. It is essential to keep in check that the written agreement abides by all the instructions and rules that are applicable to the sale of shares. It is very important that all sections are factual and there is no conflict between the agreement and directions.

There are several points that should be mentioned in a clash-free stock purchase agreement which are declared as follows.

- Company’s Name and Location: The legal and registered company's name, along with their location, should be mentioned in the contract.

- Information of Purchaser and Seller: The purchaser and seller’s name with their complete information should be included in the document.

- Value and Number of Stocks: The value of stocks per share, including the number of shares being sold, should be written.

- Warranties of Seller and Purchaser: One section should contain the warranties from both seller and purchaser's sides. This is the guarantee stating that the company is in a good position.

- Purchase and Sale: This portion specifies that the certificates will be recognized. Following this, the parties take responsibility for the transfer of taxes.

- Termination: In this portion, different situations are mentioned that would lead the seller or buyer to terminate the simple stock purchase agreement.

Asset Purchase vs. Stock Purchase

While forming a structure of sale of a corporation establishment, transactions can be made in two ways. The purchase can be regarding the company's assets, or it can be the deal of corporate stock. There are differences that should be known between an asset purchase and a stock purchase that can be observed below.

- Assets Purchase

- Stock Purchase

In an asset purchase, the buyer only buys specific assets and liabilities from the seller. Assets purchase are preferred if the buyer purchases assets of the company that are devalued, which then allows the buyer to step up the tax value on those assets.

The buyer in this purchase is only accountable for the risks of specific assets. In assets purchase, the buyer has a lead that he can calculate the liabilities of assets. If he thinks a certain asset has a risk of depreciation, then he can opt out of that asset.

In a stock purchase, the buyer is subjected to buy the whole entity along with its all assets and liabilities. In this kind of purchase, the buyer is not entitled to rewrite the agreement or consider the consent of the seller in any step. This fair and straightforward deal is carried by the buyer who simply buys the entities and has a complete hold on the benefits and loss.

However, in stock purchase, the buyer cannot claim any tax benefit, and he has to buy the unwanted assets and liabilities altogether.

Conclusion

The article has introduced the importance of stock purchases and their effect on the economy in today's world. The attributes of preferred and common stocks are also mentioned. The article has concluded the importance of the stock agreement template and how it holds credibility in legal matters.