Agreements can have a very varied shape; in terms of the formal tone, they adhere. A Payment Agreement may sound quite formal to a general consumer, where it involves the concept of basic finances. If you consider a general Payment Agreement template, they can involve two business parties and can even lend across family members.

Realizing the formality involved in this simple agreement, the major role devised is for spelling out the obligations involved in paying out a certain loan. The major idea is to ensure that the lender of the loan is protected in all cases.

What is A Payment Agreement

Payment Agreements can be recognized as the basic contracts that are marginalized among a lender and a borrower. These agreements are usually developed in such conditions where a certain party has to offer a loan to another party. Setting up the loan involves wrapping up a set of terms and conditions that are obligatory to be followed.

The tone that is usually kept in a basic Payment Agreement contract varies according to the parties that are included within the contract. If the agreement is settled between family members while taking up a loan, the conditions and environment set across the contract are very light and liquid. A formal contract, on the other hand, takes up a more solid tone.

The stakeholders involved in the contract have to ensure that both parties have protected their formal rights without sabotaging the opposite party's rights. This not only acts as the contract providing the boundaries of the loaning but features as the receipt in the future. The contract outlines a detailed plan that would guide the lending party to cover the loan over a dignified time period.

Why Do You Need a Payment Agreement?

Payment Agreements are held important in cases where the money is lent among two parties. It serves as a legal recourse and a legal parchment for parties that have lent money to another party. Without a proper Payment contract, the parties cannot define an appropriate time period for covering the payments.

Payment agreements guide the parties in setting up a prolific payment plan that would keep the complete system intact. The formal, legally binding contract parchment is essential for stakeholders to keep them in the hold of situations where the lent money gets defaulted. This financial obligation gives the lender a legal remedy to get across the other party if they fail to provide the payments as planned.

Keeping every financial detail of the loan saves the parties from any assorted confusion with appropriate assurances. It is important for both parties to ensure that a Payment Plan Contract is being written. This contract should be considered in cases where you plan to lend or borrow money. In other situations, you can also set up such a contract for designing an amortization table.

This piece of the contract helps people organize significant data and details correctly, which would guide people to keep the complete loan process coordinated and protected.

What Should be Included in a Payment Agreement?

Payment Agreements can be both simple and complex, depending on the intensity of the plan the parties are working on. These agreements can include rigorous details of the payment plan; however, they can vary from one loan process to another.

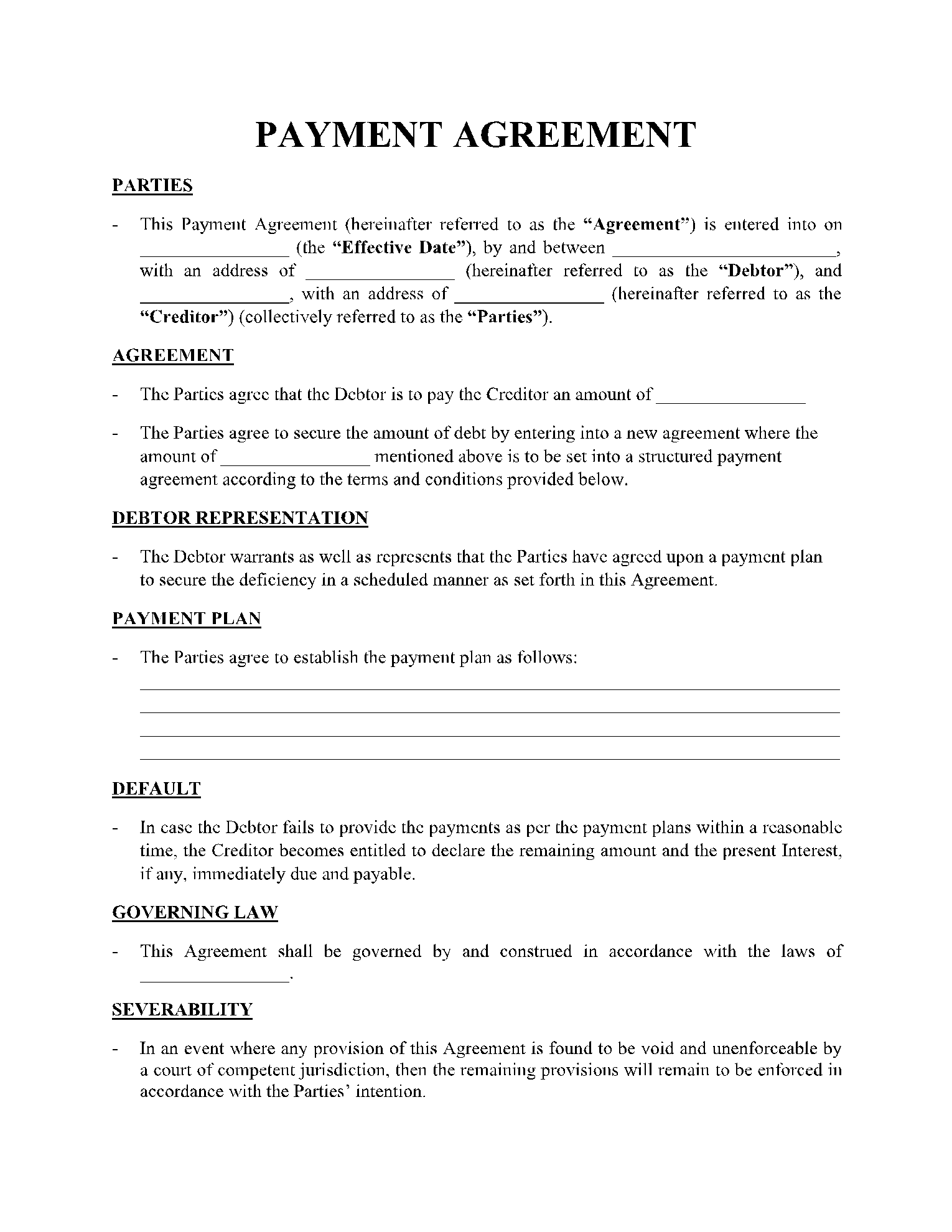

Such agreements demand the establishment of the terms and conditions for the loan payment. There are a set of imperative elements that comprises a general Payment Agreement.

- Parties: Mention the parties, i.e., the lender and the borrower included in the agreement.

- Date: Include the date this agreement has been signed and put into effect after immediate signatures.

- Finances: Include the total amount of the money that the borrower has to return to the lender.

- Payment Plan: Set up a payment plan or installments, which is to be followed by the borrower.

- Term Penalties: Mention the due dates and the penalties that are to be paid over late submissions.

- Grace Periods: Include the time parameters that are to be considered as the pardon period.

- Contact Information: Provide the contact details of the parties involved in the agreement.

Common Mistakes to Avoid When Drafting a Payment Agreement

Your Payment Agreement template can include several mistakes that should be avoided to abstain from legal remedies. These mistakes should be initially recognized and then avoided during their drafting. To understand the basic mistakes while designing an agreement, you should avoid the set of mistakes as shown below.

- The agreement that has been designed may not be complete and would lack several pieces of information.

- The major motive of the agreement is not explained clearly.

- The agreement fails to mention the complete amount of the loan payment that is to be paid.

- The lender and the borrower have not developed a proper payment plan that is not attainable realistically.

- The agreement does not contain the complete set of signatures required for its ratification.

- The language within the payment agreements is being set as too complicated to understand and apprehend.

- The penalties within the terms and conditions are not included perfectly.

- The parties fail to realize the importance of consulting with an attorney to receive legal advice.

- Lacking information is detected within the written parchment.

Conclusion

It is significant to understand that writing a Payment Agreement is quite unique and detailed in context. Several details are to be specifically included within the agreement to ensure that a proper subjected payment plan is being offered. While assuring all the details, the parties should make sure to avoid all the common mistakes that can be a part of the agreement. This would help them in writing a perfect agreement for setting up appropriate limitations for the parties.

If you want to get everything right, you can use the payment agreement template here, and edit this PDF document with CocoDoc. You'll be able to create a valid agreement template easily